[Raw Material] The ex-factory quotation for small-sized semi coke was about 1080-1180 CNY/T; The factory price of silica was around 220-260 CNY/T; The price of oxide skin was around 970-1000 CNY/T; The electricity prices in Inner Mongolia ranged from 0.38 to 0.40 CNY//kWh.

[Spot Market] The cost has slightly decreased, profits have increased, and the ferrosilicon production remained stable and there was a strong reluctance of manufacturers to sell; The steel tender in December was coming to an end, with the traditional off-season combined with continuous snowfall and cold weather, downstream demand was weak, and the transactions were average. However, after rebounding last week, the futures rose slightly, and analysis believed that December to January would be a key time point for this round of winter storage and market had expectations for that, which has led to an improvement in sentiment, and spot prices remained stable. This week, the quotation for 72# ferrosilicon standard blocks was mostly around 6700-6800 CNY/T, while the quotation for 75# ferrosilicon standard blocks was around 7100-7300 CNY/T.

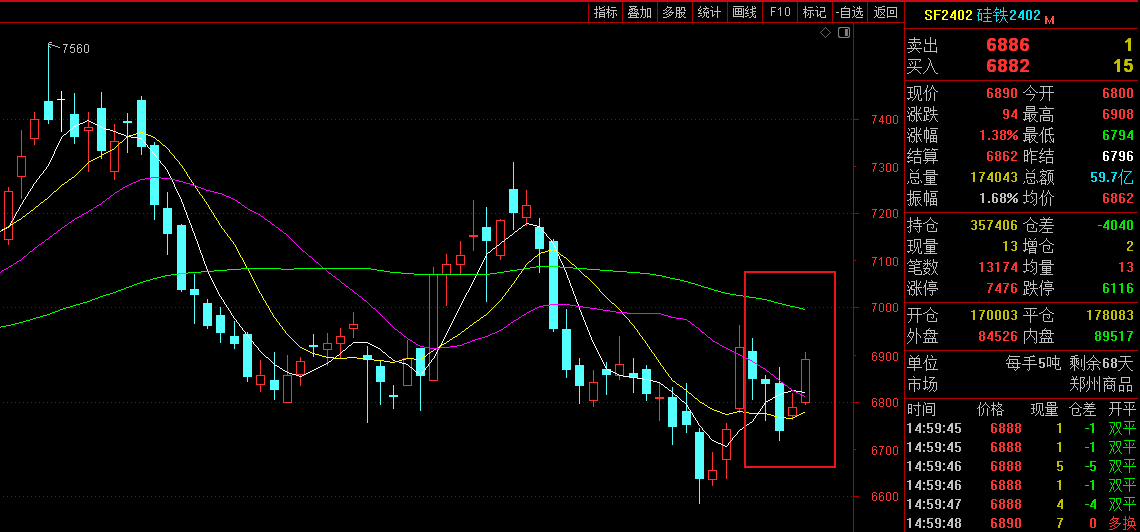

[Futures Market] The opening price of 2402 main contract was 6,908, the highest price was 6,936, the lowest price was 6,718, the closing price was 6,890, the settlement price was 6,862, the position was 357,406, the trading volume was 841,716, and the transaction amount was 28.7151 billion yuan, an increase of 0.12%.

Below are Ferrosilicon Futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Range |

Trading volume |

Positions |

Trading value (10000’ tons) |

|

12.11 |

6908 |

6936 |

6804 |

6848 |

6852 |

-0.49% |

192408 |

362324 |

659109.25 |

|

12.12 |

6848 |

6858 |

6760 |

6838 |

6806 |

-0.20% |

170925 |

365946 |

581577.59 |

|

12.13 |

6840 |

6874 |

6718 |

6738 |

6792 |

-1.00% |

178639 |

369933 |

606678.29 |

|

12.14 |

6772 |

6822 |

6762 |

6790 |

6796 |

-0.03% |

125701 |

361446 |

427044.28 |

|

12.15 |

6800 |

6908 |

6794 |

6890 |

6862 |

1.38% |

174043 |

357406 |

597100.76 |

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think