【Ferro-alloys.com】: The Simandou project in Guinea threatens to further change the dynamics of the iron ore market, which is already facing an uncertain future in terms of demand, writes Bloomberg.

Internal forecasts by some of the world’s largest mining companies indicate that the price of iron ore will fall to $85/t over the next three years as Simandou in Guinea reaches full production capacity within the next 2.5 years.

Even more optimistic forecasts suggest that ore prices will be kept at the current level above $100/t, which is less than half of its peak value in 2021, the agency notes.

Simandou is the world’s largest unexplored iron ore deposit, with reserves estimated at at least 3 billion tons. The raw materials from this deposit have an average iron content of over 65%. SimFer is a joint venture between the Guinean government, Rio Tinto, and Chalco Iron Ore Holdings, which brings together leading Chinese companies, holds a concession for mineral extraction in blocks 3 and 4 in the south of the deposit, while the Singapore-Chinese consortium Winning Consortium Simandou (WCS) holds blocks 1 and 2 in the north.

The first batch of ore from Simandou is scheduled to be loaded at the end of November and shipped from Guinea at the end of the year, when a Newcastlemax bulk carrier will depart with approximately 200,000 tons of raw materials extracted by both consortiums.

Rio Tinto will need another year to complete the construction of the mine and port. The company plans to increase production to 60 million tons per year within 30 months. WCS, on the other hand, has not disclosed its timeline for reaching the same level of production. The combined volume is equivalent to approximately 5% of global production in 2024.

Simandou is called the “Pilbara killer” because of its potential impact on Western Australia’s iron ore mines. The mine will strengthen China’s ability to undermine the influence of mining giants such as BHP, Vale, and even Rio Tinto itself.

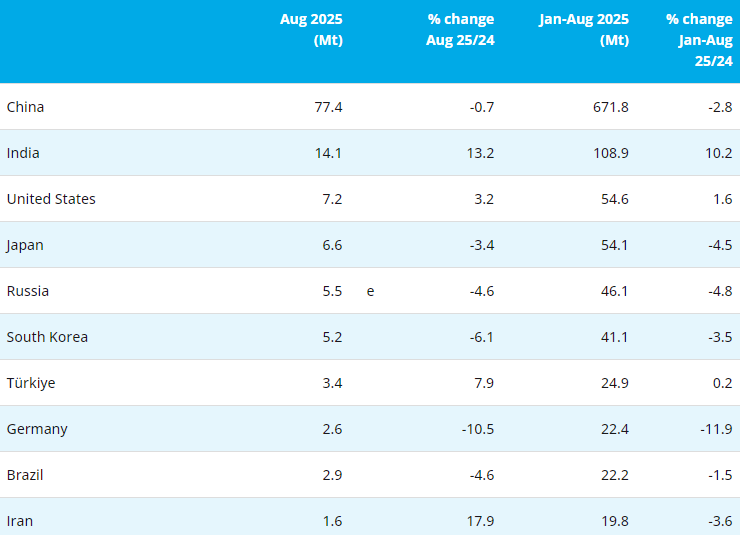

Over the past two decades, China’s demand for iron ore has been very high, as it produces half of the world’s steel. However, this production volume has probably peaked.

In just three years, state-owned trader China Mineral Resources Group has become the world’s largest buyer of this raw material, controlling purchases for most Chinese state-owned steel companies. In September this year, CMRG escalated its dispute with BHP, which refuses to offer the same discounts as its competitors. In addition, last year, the state-owned China Baowu Steel Group also acquired the largest stake in WCS. Today, Chinese firms own most of the project.

Earlier, it was reported that Rio Tinto had accumulated 2 million tons of high-quality iron ore at the Simandou project in Guinea for shipment of the first batch in mid-November.

- [Editor:Alakay]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think