The ferrosilicon production declined at the supply side obviously after the furnaces shut down in the producing areas. According to statistics, the national ferrosilicon output in July was about 450000-460000 tons; With the gradual repair of the downstream steel market, the market turnover increased slightly, and the inventory was also decreased to some certain. This week, major steel mills successively released tender information: the tender price of 75B ferrosilicon of Fujian Sangang Group in August was 8200 yuan per ton, down 380 yuan per ton from July, and the volume was 1400 tons; In August, the tender price of 75B ferrosilicon of Jiangsu big steel plant was 8100 yuan per ton, down 200 yuan per ton compared with July, and the volume was 2000 tons; The 75B ferrosilicon tender of HBIS Group in August was 2100 tons, 160 tons less than that in July. The tender price has improved compared with the previous trough period, and the spot market of ferrosilicon has temporarily operated stably, but the Futures rose and fell, and the market sentiment was still cautious. After all, the contradiction between supply and demand has not been eliminated, the inventory pressure was still large, and the consolidation operation may continue in the later stage.

On the downstream side, according to the latest data of CISA, in late July 2022, the key statistics showed that steel enterprises produced a total of 20.792 million tons of crude steel, with a daily output of 1.8902 million tons, a month on month decrease of 7.25%; In late July, the steel inventory of iron and steel enterprises was 16.5966 million tons, a decrease of 2.4347 million tons or 12.79% over the previous ten days; It decreased by 352000 tons or 2.08% compared with the end of last month (that is, the same ten days of last month); An increase of 5.2997 million tons or 46.91% over the beginning of the year; It increased by 2.783 million tons or 20.15% over the same period last year. The policy of stabilizing growth has been constantly promoted, and the package of measures has been effective, driving the gradual recovery of downstream steel demand. With the easing of cost pressure, the continuous removing of steel enterprises, and the gradual restoration of profits, steel enterprises have resumed production in succession; But after all, the resilience of demand in the off-season was insufficient, there were still many uncertain factors at home and abroad, and the market sentiment was still cautious.

In terms of metal magnesium, due to the continued low demand in the off-season, the magnesium market continued to be under pressure and weakened slightly. On Friday, the mainstream ex-factory cash quotation including tax of 99.9% magnesium ingots was about 22600-22800 yuan per ton. In the absence of positive news, people in the industry had a cautious attitude towards the market, and most of them choose to wait and see. Follow up the transaction.

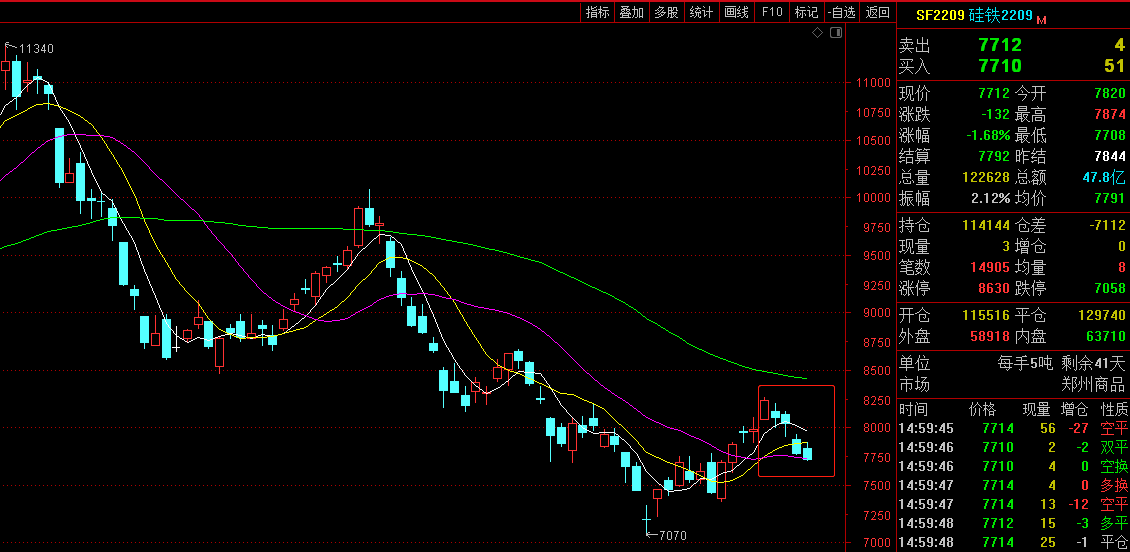

The weekly opening price of 2209 main contract was 8,072, the highest price was 8,272 the lowest price was 7,708, the closing price was 7,712, the settlement price was 7,792, the trading volume was 696,692, and the position was 114,144, down 3.31%.

Below are ferrosilicon Futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Trading volume |

Positions |

Range |

|

8.1 |

8072 |

8272 |

8060 |

8240 |

8188 |

165306 |

130019 |

3.31% |

|

8.2 |

8140 |

8210 |

7990 |

8078 |

8098 |

143059 |

119683 |

-1.34% |

|

8.3 |

8118 |

8138 |

7918 |

8028 |

8046 |

114152 |

112557 |

-0.86% |

|

8.4 |

7898 |

7940 |

7760 |

7768 |

7844 |

151547 |

121256 |

-3.46% |

|

8.5 |

7820 |

7874 |

7708 |

7712 |

7792 |

122628 |

114144 |

-1.68% |

- [责任编辑:kangmingfei]

收藏

收藏 打印

打印 信息快递

信息快递 行业报告

行业报告 期刊杂志

期刊杂志 企业名录

企业名录 短信彩信

短信彩信 数据定制

数据定制 会议服务

会议服务 广告服务

广告服务 贸易撮合

贸易撮合 企业网站建设

企业网站建设

在线询价

在线询价 联系方式

联系方式

评论内容